China has been one of the biggest oil battlegrounds in recent years, with producers clawing for coveted market share in the world’s most populous country.

Traditionally, Saudi Arabia has dominated the market, but its exports have plateaued over the last few years. And this has opened a window for other producers such as Russia to get in on the action.

“How have the Saudis fared? Not very well. Actually, quite miserably,” Michael Tran, a commodity strategist at RBC Capital Markets, wrote back in September.

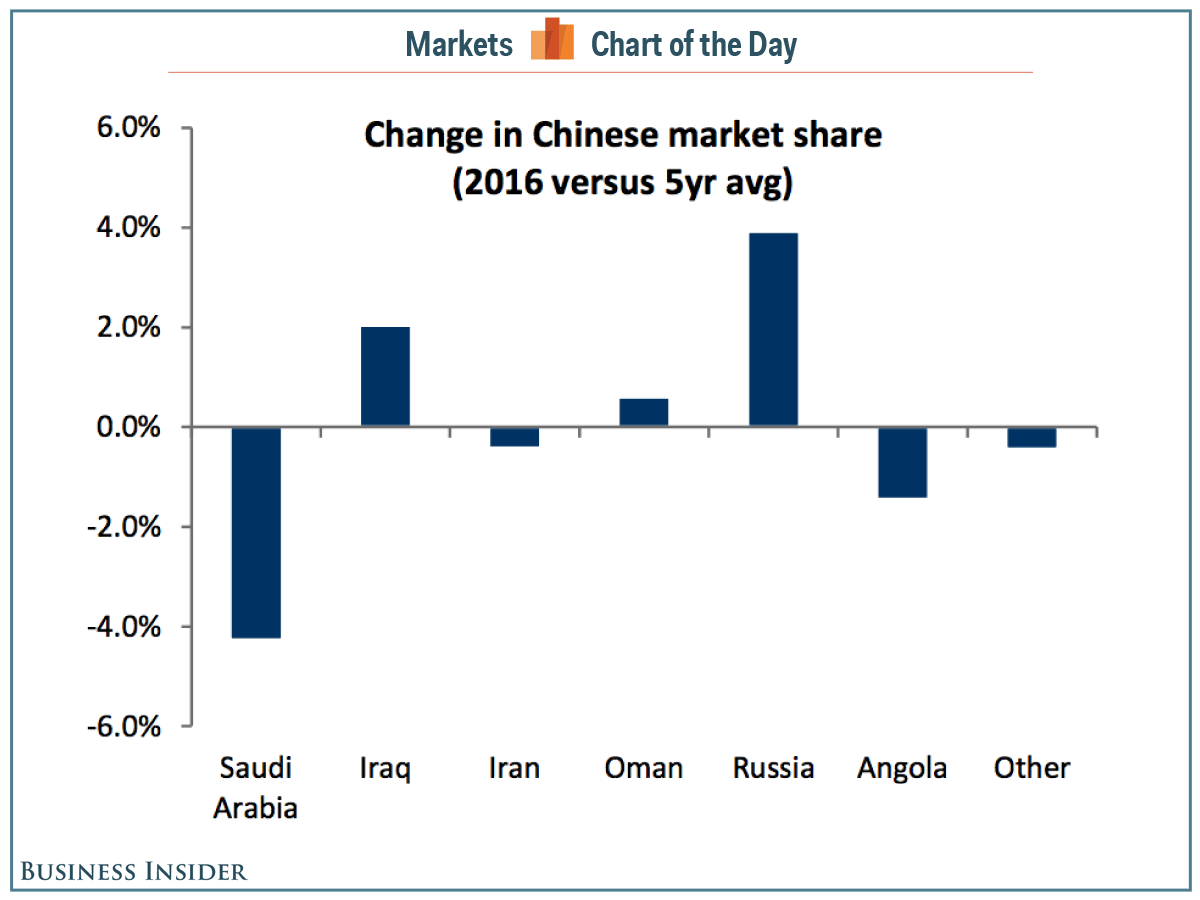

In a recent note to clients, RBC Capital Markets’ commodity strategy team shared a chart showing the change in Chinese oil market share in 2016 compared to the five-year average. The most striking things from the chart are 1) Saudi Arabia’s drop and 2) Russia’s increase.

“China has been the primary pillar of global demand growth; yet, the Saudis have had a difficult time maintaining their historical stranglehold on that market,” wrote the RBC Capital Markets team.

"Recent price moves suggest that Saudis' messaging around the OPEC deal has proven successful, but the ground game in key demand regions is where the war will be won."